What Does Summitpath Llp Do?

What Does Summitpath Llp Do?

Blog Article

Summitpath Llp for Dummies

Table of ContentsThings about Summitpath LlpThe Basic Principles Of Summitpath Llp How Summitpath Llp can Save You Time, Stress, and Money.Excitement About Summitpath LlpFacts About Summitpath Llp UncoveredSummitpath Llp for DummiesTop Guidelines Of Summitpath Llp

Advancement in the field can take many forms. Entry-level accounting professionals may see their responsibilities raise with yearly of practice, and this may qualify them to relocate right into management placements at greater incomes. Accounts in senior manager, management or exec duties typically will require a master's level in accounting or a master's of organization management (MBA) with a concentrate on accountancy.Here is a sampling of specialties they can pursue: Help individuals choose about their cash. This can include suggesting them on tax obligation legislations, financial investments and retirement planning. Keep sensitive monetary details personal, usually functioning with IT professionals to secure modern technology networks and avoid protection violations. Identify the value of assets, with the assessments used for economic filings or sale of the assets.

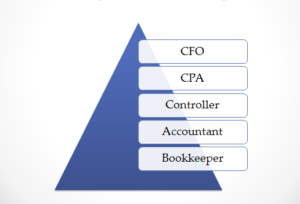

As an example, administration accountants frequently begin as expense accountants or younger internal auditors. They can progress to accountancy supervisor, chief cost accountant, spending plan supervisor or supervisor of interior bookkeeping. Some relocate right into company administration or company money, where they might work as controllers, treasurers, financial vice presidents, primary financial police officers or corporation head of states.

Summitpath Llp - The Facts

There are a number of bookkeeping levels. The lowest, an associate level in accountancy, will certainly qualify you for clerical functions under an accounting professional. There are five usual kinds of accountants. For these functions, you'll require at the very least a bachelor's level and to become a licensed public account (CERTIFIED PUBLIC ACCOUNTANT), a credential that you can make after you finish your degree.

An administration accounting professional is a vital function within a service, yet what is the role and what are they anticipated to do in it? ICAEW digs deeper in this monitoring accountant guide. A monitoring accounting professional is an essential duty in any organisation. Functioning in the accountancy or money division, management accounting professionals are accountable for the preparation of monitoring accounts and numerous various other records whilst also looking after general audit procedures and methods within the organization.

The 10-Minute Rule for Summitpath Llp

Secret economic data and records generated by management accounting professionals are used by senior administration to make educated service decisions. The analysis of business performance is an essential function in a management accountant's work, this analysis is created by looking at existing monetary details and additionally non - financial information to determine the setting of the organization.

Any type of organization organisation with an economic department will need a monitoring accountant, they are also frequently utilized by monetary establishments. With experience, a monitoring accounting professional can expect solid occupation development.

Can see, review and recommend on alternating sources of service financing and various means of elevating money. Communicates and recommends what effect financial decision making is having on developments in law, values and governance - https://summitp4th.wordpress.com/. Assesses and recommends on the best approaches to take care of business and organisational performance in useful link connection with service and finance danger while interacting the impact efficiently

Excitement About Summitpath Llp

Advises the appropriate techniques to guarantee the organisation adheres to administration frameworks and applies finest technique internal controls. Makes usage of danger management approaches with the ideal interests of the company and its stakeholders in mind.

Uses numerous ingenious approaches to carry out method and manage modification. The distinction in between both monetary bookkeeping and managerial accounting worries the designated customers of info. Supervisory accounting professionals call for company acumen and their aim is to function as company partners, assisting company leaders to make better-informed decisions, while financial accounting professionals aim to create economic papers to provide to outside celebrations.

An understanding of organization is additionally important for management accounting professionals, along with the ability to connect successfully in all degrees to recommend and liaise with elderly participants of personnel. The obligations of a monitoring accounting professional ought to be performed with a high degree of organisational and calculated reasoning abilities. The average income for a chartered monitoring accounting professional in the UK is 51,229, a rise from a 40,000 ordinary gained by management accounting professionals without a chartership.

How Summitpath Llp can Save You Time, Stress, and Money.

Flexible work options, consisting of crossbreed and remote routines. To use, please send your resume and a cover letter outlining your qualifications and passion in the elderly accountant function.

We're anxious to discover a skilled elderly accounting professional ready to contribute to our company's economic success. HR call information] Craft each area of your job summary to show your organization's distinct demands, whether working with an elderly accounting professional, business accountant, or an additional professional.

: We're a relied on leader in financial solutions, committed to precision and advancement. Our accountancy team thrives in a helpful and collaborative atmosphere, with accessibility to cutting-edge technology and constant learning chances.

Facts About Summitpath Llp Revealed

A solid accounting professional job account exceeds listing dutiesit plainly connects the credentials and expectations that align with your organization's requirements. Separate between vital credentials and nice-to-have skills to assist prospects gauge their suitability for the placement. Define any type of accreditations that are compulsory, such as a CPA (State-licensed Accountant) license or CMA (Certified Monitoring Accounting professional) designation.

Adhere to these finest methods to produce a job description that reverberates with the ideal candidates and highlights the distinct aspects of the function. Accounting duties can vary extensively relying on ranking and expertise. Avoid obscurity by detailing particular jobs and locations of emphasis. "prepare regular monthly financial declarations and look after tax filings" is far clearer than "take care of economic documents."Mention key locations, such as financial coverage, auditing, or payroll monitoring, to draw in prospects whose abilities match your needs.

Summitpath Llp Things To Know Before You Buy

Describing accounting professional job summaries for resume development is a smart transfer to obtain your creative juices streaming - bookkeeping service providers. By assessing the job descriptions, you can analyze and make a listing of what skills and experience you have that align with them. From there, you can include them right into your resume

Report this page